By Baskut Tuncak, Senior Attorney Environmental Health Program

As negotiators prepare for the next round of negotiations between the U.S. and EU on a new trade agreement, an ‘investor’ has filed a lawsuit against Canada under an old one. Lone Pine Resources filed suit under the North American Free Trade Agreement (NAFTA) seeking $250 million Canadian dollars in damages due to Quebec’s moratorium on’ fracking’ for natural gas. Under NAFTA and other international agreements that contain provisions for “investor-state dispute resolution,” foreign corporations can bypass domestic courts and sue governments in private tribunals over public health and environmental protection measures that the corporations allege breach the investor provisions of the trade agreement. In this case, Lone Pine is attempting to undermine Quebec’s moratorium on fracking.

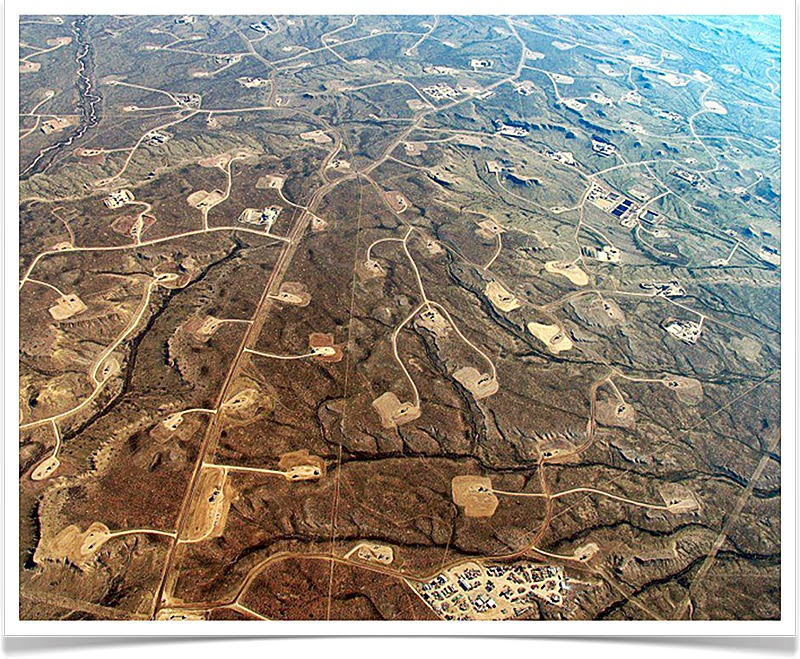

Not to be confused with conventional natural gas extraction, fracking is a highly-controversial method of extracting natural gas by injecting a secret mix of chemicals underground. Fracking has produced such fierce controversy because: (1) there have been numerous instances of contaminated water supplies; (2) there is no assurance that the chemicals that remain underground are safe; (3) the public lacks adequate assurance that the recovered fracking fluid can be disposed safely; (4) nearby communities cannot make informed decisions without knowing all of the chemicals that are used and associated risks; and (5) legitimate questions exist about whether the greenhouse gas footprint of natural gas recovered from fracking is actually as low as proponents claim it to be. While proponents argue that the percent of chemicals in fracking fluids is small, the total volume of chemicals is not insignificant. This small percentage amounts to tons of chemicals being injected per well.

The inclusion of such extreme investor provisions in trade and investment deals has enabled powerful interests, from tobacco companies to mining companies to corporate polluters, to use investor-state dispute resolution to challenge and undermine consumer, public health, and environmental protections. Under recent U.S. trade agreements, no less than 15 cases have challenged measures to prevent exposure to toxic chemicals, including notorious bad-actors that are now restricted under the Stockholm Convention on Persistent Organic Pollutants. Companies have created subsidiaries in the US or other countries simply to take advantage of these provisions, as is the case with Lone Pine Resources – a company with operations exclusively in Canada that created a U.S.-subsidiary to seek access to these investor provisions of NAFTA.

Today, many if not most corporations have an international presence, including both in the U.S. and EU. If investor-state dispute resolution provisions were to be included in the potential Trans-Atlantic Trade and Investment Agreement (TTIP) an entirely new legal venue would be created for these companies, which would bypass public legal proceedings in favor of private tribunals that have very little transparency and accountability, as well as limited opportunity for public participation and input. Public health issues involving the use of chemicals in our environments are precisely that: a public health issue. Investor state dispute resolution provisions not only deprive the public of an open, transparent debate on the issues, but they also place the public in a lose-lose situation, either slowing the creation or implementation of public health and environmental measures, or using public resources to compensate investors.

Both the U.S. and EU already have robust legal systems in place. TTIP could be enforced through the ordinary courts of the U.S. and EU. There is no pretext for placing Europeans or Americans in a lose-lose situation, a situation that would have a chilling effect on the future development of laws and other measures to protect public health and the environment.

Originally posted on October 7, 2013.